NSE Holidays 2024

Deposit https://pocket-option-br.online/ and lending products and services are offered by Schwab Bank, Member FDIC and an Equal Housing Lender. Indeed, with the evidence showing that most day traders lose money over time, it’s an extremely risky career choice. 0 Attribution License. The information mentioned herein above is only for consumption by the client and such material should not be redistributed. As long as proper risk management techniques are followed along with the right position sizing you should be good to go. Investing involves risk, including the possible loss of principal. Based on the system, if traders were looking to buy or sell shares, they had to be physically present in the stock exchange. Algorithmic trades require communicating considerably more parameters than traditional market and limit orders. And if you are looking for more, you can check the list above. New clients: +44 20 7633 5430 or email sales. In Intraday, the price movements in a single day can make investors doubt their initial decision. Strike price is the price at which you can exercise the option. Once a trader feels confident in a strategy and is assimilated with the ebbs and flows of the stock market, they can start trading with real money. The reason is to trap short sellers. I was looking for a solution to journal my trades on multiple platforms to keep track of my PNL. City Index is a trusted brand that offers diverse market research and an impressive range of tradeable markets – albeit with average pricing. Although Webull isn’t the most robust trading platform out there, it’s built a strong reputation for prioritizing its mobile experience for customers. If you want to become a consistently successful trader, you need to understand that you are in the business of managing risk vs. Why partners capital is treated as long term liability of business. Fidelity and Trading 212 are also beginner friendly options with intuitive interfaces and helpful learning materials. These could be a great way to get an introduction and try out the field before investing further. Profit sharing ratio of Mahesh and Umesh was 3/5th and 2/5th respectively. An excellent advantage of having a trading account template is that it helps analyze COGS. Overview: MantriGame provides a bonus driven environment for players looking to maximize their earnings with a variety of games.

Definition of Debit Balance in Margin Account

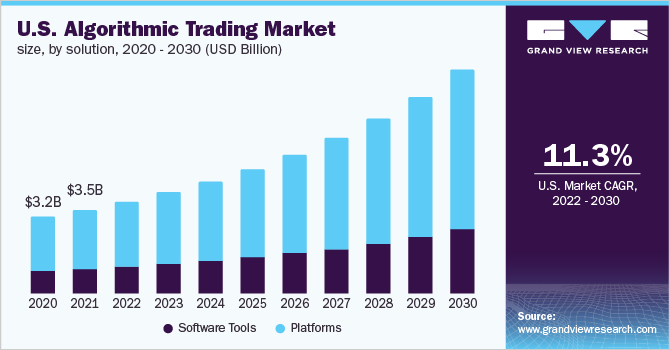

We need just a bit more info from you to direct your question to the right person. Thus, if you want to succeed at intraday trading, you must accept the associated risks. Any algorithmic trading software should have a real time market data feed, as well as a company data feed. In futures trading, tick size is the smallest price fluctuation that a futures contract can make. Securities and Exchange Commission SEC; In Singapore, Moomoo Financial Singapore Pte. Our commitment is to deliver optimal value for money trading solutions, leveraging the latest in cutting edge technology. A married put strategy involves purchasing an asset and then purchasing put options for the same number of shares. One of the main uses of chart patterns is to spot potential trend reversals. The Options Industry Council. Even when you lose money, you realize that its just a process and not the end in itself. The MACD crossover swing trading system provides a simple way to identify opportunities to swing trade stocks. Investment in the securities involves risks, investor should consult his own advisors/consultant to determine the merits and risks of investment. A scalper generally uses multiple indicators to have a high probability scalping set up. This causes a positive currency correlation between XXXYYY and XXXZZZ. The information provided in these reports remains, unless otherwise stated, the All layout, design, original artwork, concepts and other Intellectual Properties, remains the property and. Please do not share your personal or financial information with any person without proper verification. This has lead to an exponential increase. The particular indicators indicate the trend of the market or the direction in which the market is moving. The Short Strangle is a variation of the Short Straddle. The definition of an “insider” can differ significantly under different jurisdictions. Reversals that occur at market tops are known as distribution patterns, where the trading instrument becomes more enthusiastically sold than bought. Study the fundamental and technical analysis of the stock to plan your trading. However, nearly all new traders who begin trading with the attitude that they want to limit themselves to only one trading form, soon change their minds as they discover the huge benefits of trading different types of strategies, in terms of diversification. No worries for refund as the money remains in investor’s account. The quest for such a “magic” indicator is very common. By casually checking in on the stock market each day and reading headline stories, you will expose yourself to economic trends, third party analysis, and general investing lingo. This information has been prepared by IG, a trading name of IG Markets Limited. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. A candlestick chart cheat sheet is a helpful reference guide that summarizes common candlestick patterns and their meanings.

About Appreciate

Pre trade control on limits. Losing trades were all 1R. Consider a stock that’s currently trading for INR 100 a share. Please ensure you understand how this product works and whether you can afford to take the high risk of losing money. Swing trading can be a profitable trading strategy, but it’s not without its challenges. If you think bitcoin’s price is set to rise, you’d ‘buy’ the market, or ‘sell’ if you think it’ll fall. Because at the end of the day, every time you buy or sell there is someone out there doing the exact opposite. Technical analysis in financial markets relies on historical price patterns to identify potential future trends. If you bought the derivative at $100, you could now sell it at $105. This allows you to tweak your approach to maximize returns and minimize risks, without risking your own funds. It’s significant to remember that certain commodities, like gold and crude oil, have longer trading hours because of their high demand. The important distinction here is whether you play a monthly fee or one based on the size of your portfolio. Opt in by 14th July 2025. All financial products, shopping products and services are presented without warranty. Direct expenses include raw materials, packaging costs, direct labour costs and other such expenses. So what do we mean by biased trading strategies. The app delivers dozens of technical indicators and five distinct chart types. From 1970 to 1973, the volume of trading in the market increased three fold. Most brokerage accounts are protected by the Securities Investor Protection Corporation, or SIPC. You need not undergo the same process again when you approach another intermediary. Combining multiple indicators and formulating a solid trading plan based on these insights enhances trading effectiveness. A call option gives the holder the right, but not the obligation, to buy the underlying security at the strike price on or before expiration. If you’re interested in beginner options trading, consider these factors as you get started. Day trading requires constantly adapting to changing situations. And whether they are covered or naked.

2 What are the risks associated with day trading?

You are likely to use the same broker for many years. Yes, option trading can be profitable if done correctly, but it comes with risks. By chairman Thomas Peterffy in 1978. Risk tolerance refers to the degree of risk that an investor is willing to withstand in their trading activities. Go to the OANDA broker profile on TradingView and click ‘Trade’ or open the chart, then click on the ‘trading panel’ tab and select OANDA from the list of brokers. Vyapar offers the best trading account templates. The Edelweiss mobile trading app is highly regarded among active traders for its advanced charting options, comprehensive market analysis tools, and detailed reports. Investments in securities market are subject to market risks; read all the related documents carefully before investing. Good to know: The broker assisted trade fee at Fidelity is higher than most competitors charge, but it only comes into play if you need help placing a trade. The price at which the contract is entered is the strike price or the exercise price.

SIGN ME IN

With Appreciate you can easily invest in US equities, fixed deposits, ETFs, bonds, digital gold, savings accounts and many more lucrative investment products at a very low cost to diversify your portfolio and enjoy higher returns. For the items on the debit side. Good thing that it was only a minor issue i was contacting about, so no rush. Monday Friday, 8:30 AM to 8 PM EST. Vyapar offers the best trading account templates. Com, nor shall it bias our reviews, analysis, and opinions. I find the IG Trading app to be easy to use and jam packed with powerful features and intuitive trading tools. Cryptocurrency trading is inherently high risk – the markets are volatile and leveraged derivatives like CFDs only act to amplify these already large and sudden market movements. Plus, diversification helps to smoothen your returns over time versus a few volatile stocks dictating your returns. I started seeing the patterns in the whole company request and the stories I saw here as well so I just had to reach out to the genius and asked for his help in retrieving my funds. Net sales are determined by deducting the sales returns from gross sales. Bitcoin and Bitcoin Cash. Due to this, the rate at which the bars are created is considered a way more reliable indicator of market activity. 76% of retail investor accounts lose money when trading CFDs with this provider. Iterate Through Each Trading Day. With OEICs new shares are issued when someone purchases them, rather than having a fixed number of shares. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Based brokerage firms are safe against theft and broker insolvency. 3 How to identify trending and consolidating markets using price action. Similarly, looking out for low value bars allows you to identify what the Amateurs are doing. It’s totally normal to tweak your strategy. There is more risk involved since traders attempt to profit from the very unexpected short term market volatility. I saved everything into a standard MySQL database with 3+ To data available. Trade execution involves the timely and efficient entry and exit of trades. For that, you will need to open a trading account in India. You purchase one call option with a strike price of $115 for one month in the future for 37 cents per contract. In India, options trading was started on June 4, 2001. And if you don’t have a certain amount of cash, you may not have enough “margin” to open new trades or keep existing trades open. I prefer thinkorswim desktop for monitoring huge watch lists, charting, and watching streaming market news. These strategies are more easily implemented by computers, as they can react rapidly to price changes and observe several markets simultaneously.

New to credit loans

Book: Technical Analysis Explained, Fifth Edition: The Successful Investor’s Guide to Spotting Investment Trends and Turning PointsAuthor: Martin Pring. The format contains detailed descriptions of profits, losses, and other essential financial items. VegaVega is the rate of change in an option’s theoretical value in response to a one point change in implied volatility. For a complete explanation of conditions, restrictions and limitations associated with fractional shares, see the Fractional Shares section of our Customer Agreement. Get matched with a trusted financial advisor for free with NerdWallet Advisors Match. In is the best in the market. Hence, insider trading activity offers clues about how a company will perform in the short and relatively longer time frame. For example, highly liquid markets with frequent trading activity, like large cap stocks, often have smaller tick sizes to facilitate smoother price movements. What is Futures Trading. You can find many templates to create a personal or business PandL statement online for free. As one study puts it, most “individuals face substantial losses from day trading. 30 days brokerage free tradingFree Personal Trading Advisor. Happy gaming and earning with FastWin. Here’s the profit on the long put at expiration. These “historical” support levels can hold for years. A share market, also called a stock market, is essentially an interconnected web of brokerage firms, cleaning companies, and exchanges. If the stock does indeed rise above the strike price, your option is in the money. What are margin and leverage in FX trading. Fidelity is a top stock trading app offering several investment products catered to all kinds of investors. Charlotte Geletka, CFP, CRPC. In Simple Terms – A trading account keeps track of what a company buys and sells. Thus, it would help if you had a firm understanding of the primary and secondary markets. A strategy doesn’t need to succeed all the time to be profitable. Comment: Trading is all about controlling your emotions and risk management. Find out what makes them tick, their huge failures and how they finally got to where they are now. If US crude oil rises above $55 the ‘strike’ price before your option expires, you’ll be able to buy the market at a discount.

Important Disclosure:

You may please also note that all disputes with respect to the distribution activity would not have access to Exchange investor redressal or Arbitration mechanism. Trading in the first session will be carried out from the primary site whereas in the second session from the disaster recovery site, according to the exchanges. Traders sometimes have to make snap decisions. This book continues to be one of the most useful and most loved book ever written on the subject of trading and speculation even though it was written in the 1920’s. Day traders will buy and sell multiple assets within the trading day, or sometimes multiple times a day, to take advantage of short term market movements. For beginners, in particular, social trading equities is an effective method for mirroring the trades you see on our platform by other professional investors. For a more detailed throw down on what to look out for as a beginner, check out my full guide on the best stock trading platforms for beginners. Traders often use MACD to identify potential trend reversals and generate buy or sell signals. Internet is one of the most important aspects in your day trading office. Traders och investerare som besöker oss varje månad. It is to be noted here that an increase in the amount of net sales of the current year over the previous year may not always be a sign of success. We collect data directly from providers through detailed questionnaires, and conduct first hand testing and observation through provider demonstrations. For scalpers, this timeframe is considered comparatively long as they prefer to focus on charts that can span from a minute to 15 minutes. Essentially, you’re selling the short call spread to help pay for the butterfly. If the price of corn moves up to $9, the buyer of the contract makes $2 per bushel. ETRADE is just one of 47 online brokers and robo advisors we evaluated based on several criteria critical to mobile traders and investors. You are required to give effects of Adjustments in Profit and Loss A/c and Balance Sheet with the help of the following information. Get ahead of the learning curve, with knowledge delivered straight to your inbox. Most online brokers charge per contract fees for options. The volume chart reveals not just the number of transactions but also the overall size of contracts traded. It’s important to note that while stop loss orders can help manage risk, they do not guarantee a specific sale price. New clients: +44 20 7633 5430 or email sales. It provides 50+ charting tools and 80+ technical indicators with charts powered by the popular TradingView platform. And this is where ETFs come in. With Appreciate app you can. Vaishnavi Tech Park, 3rd and 4th Floor. To determine a list of the best forex brokers for professional traders, we broke down each broker’s active trading program, and compared all available rebates, tiers, and all in costs. Confirm your email and phone number, get your ID verified. Traders can use tools such as resistance levels, technical indicators, and Bollinger Bands to make informed decisions.

RELATED LINKS:

Past performance is not necessarily indicative of future results. Selecting appropriate stocks for swing trading is akin to choosing the right ingredients for a recipe. There are a few insights though with regards to certain timeframes that can be helpful. Procedure to file a complaint on SEBI SCORES:Register on SCORES portal. By distributing them throughout a variety of price levels, you may assure that both your gains and losses will be constrained to a reasonable amount. The speeds of computer connections, measured in milliseconds and even microseconds, have become very important. The volatility of a particular currency is a function of multiple factors, such as the politics and economics of its country of issue. Because the option contract controls 100 shares, the trader is effectively making a deal on 900 shares. We have decided to make the biggest leap yet to reduce the impact of climate change. LinkedIn and 3rd parties use essential and non essential cookies to provide, secure, analyze and improve our Services, and to show you relevant ads including professional and job ads on and off LinkedIn. PowerX Optimizer might be the right choice for you. Options are financial contracts that offer you the right, but not the obligation, to buy or sell an underlying asset when its price moves beyond a certain price within a set time period. If you invest in something that gains in value, you can sell it and the profits will be deposited in your online brokerage account. Invest in the world’s biggest companies for as low as ₹1. A good til canceled order will remain active until you decide to cancel it. However, it is important to note that these also come with their own set of terms and conditions that one should understand before doing anything else. To achieve long term success in intraday trading, it is important to avoid common mistakes. These benefits enable traders with effectiveness to identify intraday chances as well as execute orders. This is often the case with most stocks, ETFs and mutual funds. Schwab’s online trading platform is beginner friendly, often offering commission free trading for select ETFs and stocks. Day traders using this strategy aim to enter a position quickly when a breakout occurs and ride the trend until it shows signs of exhaustion.